Company Overview

American Express(Ticker Symbol — AXP) is a global financial institution. The company operates a highly profitable merchant payment network. It’s products and services include:

- Charge and credit card products

- Network services

- Merchant acquisition and processing, servicing and settlement, merchant financing, and point-of-sale, marketing and information products and services for merchants

- Fee services, including fraud prevention services and the design and operation of customer loyalty and rewards programs

- Expense management products and services

- Travel-related services

- Stored value/prepaid products

My Investment Thesis

Key Performance Indicators:

- Cash Flow Growth — DCF method

- Consistent Dividend Growth

- Growing market Share — Revenues concerning the market

- EPS Growth

- Low Debt to Equity Ratio — Respective of the industry

- ROE and ROA growth

Competitive Advantages

AXP boasts of a Closed-Loop Network and Spend-Centric Model. Closed-Loop refers to AXP managing both the merchant relationship and consumer spending. Competitors like MasterCard (MA) and Visa (V) act as a middle man so to speak between the consumers, merchants and banks, as they make their money mostly off the fees they collect for providing the financial architecture needed to process financial transactions. AXP on the other hand also issues loans, charges late fees, collects interest much like traditional banks such as JP Morgan (JPM) in effect cutting out the middle man to process transactions.

This Closed-Loop business model gives American Express more control over its customers’ spending habits, financial transactions. In the company’s 2018 third-quarter conference call, CEO Steve Squeri talked about the advantages Amex’s closed-loop gives the company, as a questioner-Bill Carcache asked Squeri to outline the role of a Closed Loop with their strong credit performance. Squeri answered as follows:

good credits starts right at the beginning of the funnel, in terms of who you’re targeting, who you’re letting in, how much money you’re lending, and all of that is all about how we continue to invest in our machine learning capabilities and our data capabilities and all of that’s really powered by the closed loop and all the data that we have….And so when we look at our machine learning capability, it also helps to drive just how we set that no pre-set spending limit. And one of the huge advantages that we have is in the small business space, because in the small business space, small businesses use credit card products as a form of working capital, whether it’s charged or whether it’s lending. And to be able to set a no preset spending limit where we’re dynamically determining what the level of spend is based upon data from millions of small businesses and historical data and so forth is a huge advantage to us as well….Our model is unique and the uniqueness is it’s integrated that integration gives you the closed loop, the closed loop gives you the data, it gives you the relationships on either side and it gives you the ability to have the — to play with the economics which becomes even more important down the road from a B2B perspective. So closed loop is key for us.

Intrinsic Value Assessment

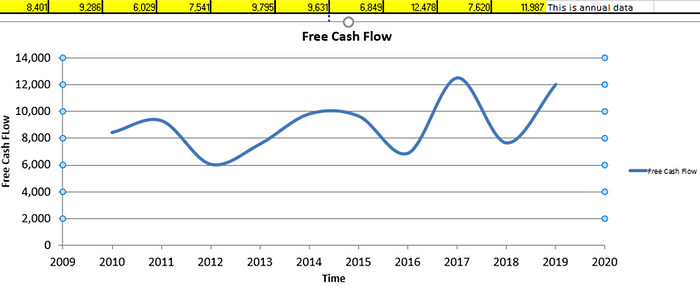

To determine the Intrinsic Value of AXP I used the Discounted Cash Flow (DCF) method. DCF uses AXP’s Free cash flows, which represents the cash a company generates after accounting for cash outflows to support operations and maintain its capital assets and estimates the value of the investment to project it’s future cash flows and justifies the price we pay now for this expected return.

The numbers in yellow are AXP’s actual free cash flows for the past 10 years. As you can see from the chart, the trend is slowly rising, though it’s not in a steady fashion as one would hope.

Next, we project out the companies future growth rate for its cash flows.

Assuming these growth rates and probabilities are accurate, AXP can be expected to give:

The most likely scenario of a 10% growth rate is actually below the 15% growth rate determined by calculating the average of the YoY FCF growth for the past 10 years.

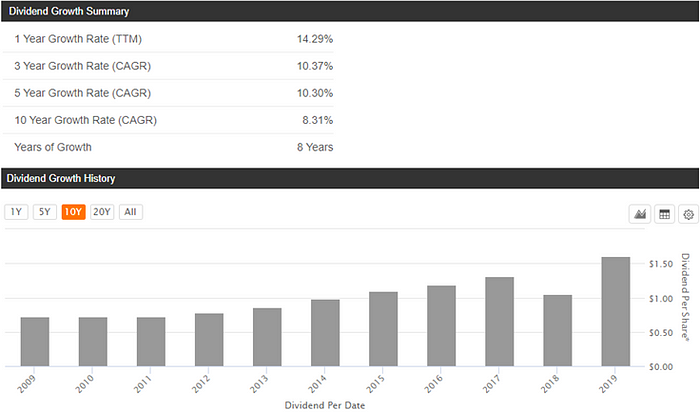

Dividend Growth

This is important as it shows discipline within management and compensates the stockholder for trusting the company with their money. An excessive offload of profits to investors via dividends can signal a loss of vision within management and their inability to seek growth. No dividends can also be destructive as holding onto profits might lead to excessive executive compensation, sloppy management, and unproductive use of assets. For the average investor, the money they have in the stock can be seen as more trustworthy when it makes its way into the shareholders pocket.

The Dividend payout ratio for AXP is currently 19.%.

Market Share Growth

With regards to its traditional competitors such as Discover Financial Services, Capital One Financial Corporation and Synchrony Financial, who are in same space as AXP (Consumer Financials), AXP has a higher revenue growth rate, market cap and cash position. But when it comes to stocks such as MasterCard, Visa and JPMorgan Chase who operate in a similar sphere and one’s who are often thrown in the same bucket as AXP, it doesn’t quite match up.

EPS Growth

Debt to Equity

Currently, AXP has a Debt to Equity ratio of 2.51, this is understandable as the company earns income via the interest it receives through loans, much like a traditional bank. The only downside to this is the obvious risk of bad loans and possible delinquencies. But AXP’s April U.S. consumer card delinquency rate of 1.7% is unchanged from March and is in line with its three-month average. This is encouraging as it emphasises the health of the loans they issue. Below is their delinquency rate from Jan 31 2020 — March 31 2020.

ROE and ROA Growth

These are important in measuring corporate performance and to understand how they allocate capital. Current Return of Equity (ROE) sits at 29.24% and return on assets are currently(ROA) 3.43%.

Growing Competition

Apart from companies such as MasterCard, Visa and JPMorgan, several new players have entered the business field that American Express is operating in. These include PayPal, Alibaba’s Alipay, Tencent’s Tenpay and Apple Pay.

Summary

While in the short term, the business model of American Express should continue to work. In the medium and longer-term, it is very hard to predict. Given the assumptions outlined in this article, an expected annual return of 10% seems like a relatively fair value.